Black Swan Event

In the realm of risk management and forecasting, the concept of a “Black Swan Event” has garnered significant attention and debate. Coined by Nassim Nicholas Taleb in his book “The Black Swan: The Impact of the Highly Improbable,” these events represent occurrences that are highly improbable, difficult to predict, and have far-reaching consequences. As our world becomes increasingly interconnected and complex, understanding and preparing for Black Swan Events is paramount. In this article, we delve into the nature of Black Swan Events, their characteristics, impacts, and strategies for mitigating their effects.

What is a Black Swan Event?

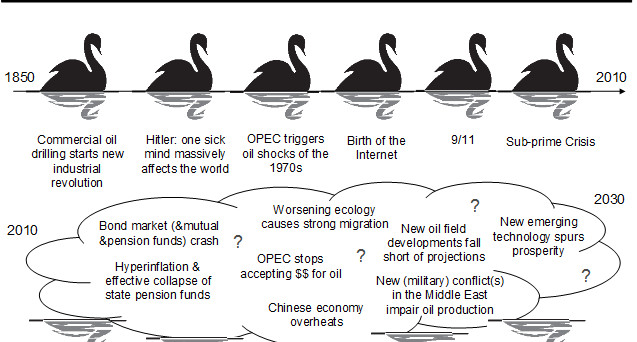

A Black Swan Event is an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. These events are characterized by their extreme rarity, their severe impact, and the human tendency to concoct explanations for their occurrence retrospectively, despite their unpredictability. The term “black swan” itself is derived from the presumption that all swans were white, based on the observable evidence until the discovery of black swans in Australia challenged that assumption.

Characteristics of Black Swan Events:

- Unpredictability: Black Swan Events, by definition, are unpredictable. They defy conventional wisdom and confound our ability to foresee them using traditional forecasting methods.

- Consequence: Black Swan Events have significant consequences, often leading to widespread disruption, economic downturns, or social upheaval. Examples include the 9/11 attacks, the 2008 financial crisis, and the ongoing COVID-19 pandemic.

- Hindsight Bias: After a Black Swan Event occurs, there is a tendency to rationalize it as if it were predictable. This hindsight bias can lead to misguided interpretations and a false sense of security in future risk assessments.

- Complex Causality: Black Swan Events typically result from a confluence of multiple factors and underlying dynamics, making their causality complex and challenging to analyze retrospectively.

Examples of Black Swan Events:

- Global Financial Crisis (2007-2008): The collapse of the subprime mortgage market in the United States triggered a chain reaction that led to a global financial meltdown. The interconnectedness of financial markets, combined with the proliferation of complex financial instruments, amplified the impact of this Black Swan Event.

- COVID-19 Pandemic: The emergence of the novel coronavirus caught the world off guard, leading to widespread illness, death, and economic disruption on a global scale. Despite warnings from experts about the potential for a pandemic, the severity and rapid spread of COVID-19 exceeded most projections.

- Brexit Referendum: The outcome of the 2016 Brexit referendum, in which the United Kingdom voted to leave the European Union, was considered a Black Swan Event by many analysts. The implications of Brexit were far-reaching and resulted in political turmoil, economic uncertainty, and diplomatic challenges.

Impact of Black Swan Events:

- Economic Disruption: Black Swan Events can trigger economic downturns, market volatility, and recessionary conditions. The uncertainty they create can undermine investor confidence and disrupt supply chains, leading to widespread financial losses.

- Social and Political Instability: Black Swan Events often have profound social and political consequences, eroding trust in institutions, fueling populist movements, and exacerbating existing societal tensions.

- Technological Innovation: Despite their negative impact, Black Swan Events can also catalyze technological innovation and adaptation. The COVID-19 pandemic, for example, accelerated the adoption of remote work technologies, telemedicine, and e-commerce platforms.

Strategies for Mitigating Black Swan Risks:

- Scenario Planning: Rather than relying solely on probabilistic forecasting, organizations should engage in scenario planning to identify and prepare for a range of potential Black Swan Events.

- Diversification: Diversifying investments, supply chains, and operational strategies can help mitigate the impact of Black Swan Events by spreading risk across multiple areas.

- Resilience Building: Building organizational resilience through robust risk management practices, contingency planning, and agile decision-making processes can enhance an organization’s ability to withstand and recover from Black Swan Events.

- Continuous Learning: Cultivating a culture of continuous learning and adaptation can help organizations stay agile and responsive in the face of uncertainty. By regularly reviewing and updating risk assessments, organizations can better identify emerging threats and opportunities.

Conclusion:

Black Swan Events represent a fundamental challenge to our understanding of risk and uncertainty. While they are inherently unpredictable, their potential impact underscores the importance of proactive risk management and resilience building. By embracing uncertainty, fostering innovation, and adopting adaptive strategies, organizations and individuals can better navigate the turbulent waters of an unpredictable world. As we continue to grapple with the complexities of the modern era, the lessons learned from Black Swan Events will remain invaluable in shaping our response to future challenges.