Check Stubs Generator free

In today’s digital age, managing finances and keeping accurate records of payments is paramount, whether you’re a small business owner, freelancer, or employee. Pay stubs, also known as pay slips or paychecks, are crucial documents that detail an individual’s earnings, deductions, and taxes withheld during a specific pay period. They serve as proof of income for employees and are essential for various purposes such as applying for loans, renting an apartment, or filing taxes.

Fortunately, with technological advancements, creating accurate pay stubs has become more accessible than ever. Free check stubs generators have emerged as invaluable tools, offering convenience and efficiency in producing professional and detailed pay stubs. Let’s delve deeper into what these generators entail and how they can simplify the payroll process.

Understanding Check Stubs Generators

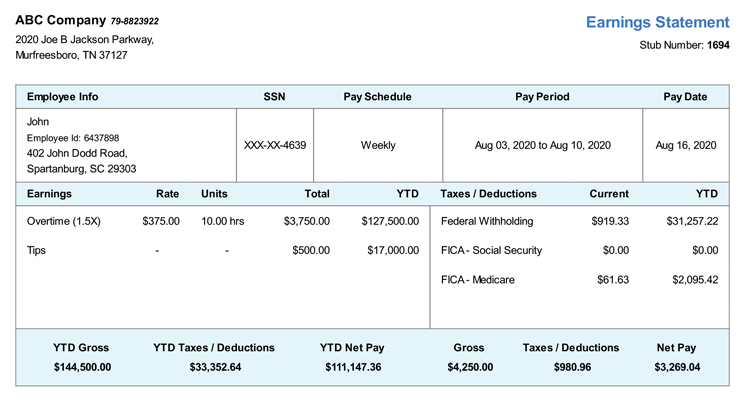

A check stubs generator is an online tool that allows users to input essential payroll information and quickly generate customized pay stubs. These platforms typically offer templates where users can fill in details such as employee information, salary or hourly rates, hours worked, deductions, taxes, and any additional earnings or withholdings. The generated stubs can then be downloaded, printed, or emailed directly to employees or clients.

Benefits of Free Check Stubs Generators

Time and Cost-Efficiency

One of the most significant advantages of using a free check stubs generator is its time-saving capability. Instead of manually calculating and formatting pay stubs, which can be both time-consuming and prone to errors, these generators automate the process, providing accurate results within minutes. Moreover, as they are free to use, they significantly reduce the expenses associated with payroll management.

Customization and Accuracy

These generators offer various templates and customization options to cater to different payment structures and specific requirements. Users can input diverse details such as hourly rates, overtime, bonuses, deductions, and taxes, ensuring the generated stubs accurately reflect the individual’s earnings. This customization feature is particularly beneficial for freelancers or businesses with unique payment arrangements.

Compliance and Professionalism

Free check stubs generators often stay updated with the latest tax regulations and payroll standards, ensuring compliance with legal requirements. They generate professional-looking pay stubs that meet industry standards, enhancing credibility and professionalism for both employers and employees.

Accessibility and Convenience

Being web-based tools, check stubs generators are easily accessible from any device with an internet connection. This accessibility ensures flexibility in creating pay stubs anytime, anywhere, without the need for specialized software or technical expertise. Additionally, users can save templates for future use, further streamlining the process.

How to Use a Free Check Stubs Generator

- Select a Reputable Generator: Choose a reliable and secure check stubs generator from the multitude available online. Look for reviews, user ratings, and features offered before making your selection.

- Input Employee Information: Enter the required details, including employee name, address, Social Security number, pay period, salary or hourly rate, and any additional income or deductions.

- Calculate and Verify: Double-check all entered information for accuracy. Ensure that calculations for taxes, deductions, and other variables are precise before generating the pay stub.

- Generate and Download: Once all details are accurately entered, generate the pay stub. Download the document in the preferred format (PDF, Word, or Excel) and securely store or distribute it to the employee or recipient.

Important Considerations and Security Measures

While free check stubs generators offer convenience, it’s essential to prioritize security and accuracy:

- Data Security: Choose generators that prioritize data encryption and secure transmission to protect sensitive employee information.

- Accuracy Checks: Always verify the information inputted to ensure correctness in calculations and details before finalizing and distributing the pay stubs.

- Legal Compliance: Stay updated with relevant tax laws and regulations to ensure generated pay stubs comply with legal requirements.

Conclusion

Free check stubs generators have revolutionized the payroll process, offering a seamless and efficient way to generate accurate pay stubs. Whether you’re an employer, freelancer, or individual in need of documenting income, these tools simplify the task, saving time and resources while ensuring professionalism and compliance.

By utilizing these user-friendly and accessible platforms, individuals and businesses can streamline their financial documentation processes, focusing on their core activities with the confidence that their payroll needs are efficiently met.