Gold Rates India

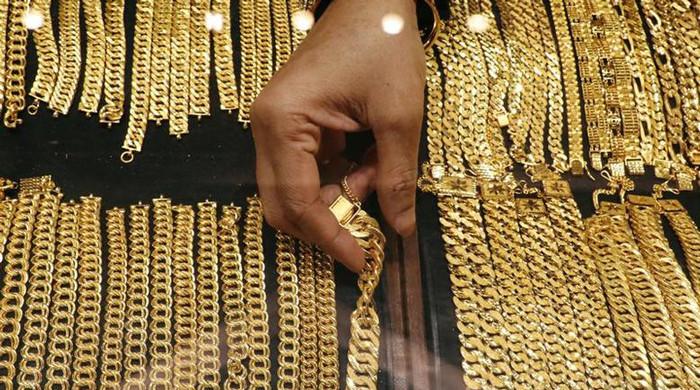

Gold has long been a symbol of wealth, stability, and prosperity in India . Deeply ingrained in its cultural, social, and economic fabric. The price of gold in India is a topic that garners immense attention and interest . Given its significance in various aspects of life. Understanding the dynamics behind the fluctuating gold rates in India . Involves delving into a multitude of factors that influence its value, demand, and market trends.

Table of Contents

ToggleHistorical Perspective:

India’s relationship with gold dates back centuries, with its roots embedded in cultural and religious practices. Traditionally, gold has been a symbol of wealth preservation and an essential part of auspicious occasions like weddings, festivals, and religious ceremonies. As a result, gold holds sentimental value and is often passed down through generations as a form of inheritance.

Factors Influencing Gold Rates in India:

Global Market Trends:

The international gold market significantly impacts the rates in India. Fluctuations in global gold prices, affected by geopolitical tensions, economic policies, interest rates, and currency fluctuations, directly influence the rates within the country.

Import Duties and Taxes:

India is one of the largest consumers of gold globally. Government policies on import duties and taxes have a direct bearing on gold prices. Changes in these regulations affect the final price of gold for consumers.

Rupee-Dollar Exchange Rate:

As gold is traded internationally in dollars, fluctuations in the exchange rate between the Indian rupee and the US dollar play a crucial role in determining the local gold rates.

Demand-Supply Dynamics:

Domestic demand for gold in India is predominantly driven by cultural sentiments and festive seasons. Any imbalance in demand and supply, owing to various factors such as mining output, investment demand, and recycling, impacts gold prices.

Inflation and Economic Conditions:

Gold often serves as a hedge against inflation and economic uncertainties. During times of economic instability, investors tend to flock towards gold, influencing its prices.

Recent Trends and Analysis:

In recent years, the gold rates in India have experienced fluctuations influenced by various global and domestic factors. The COVID-19 pandemic, geopolitical tensions, changes in central bank policies, and shifts in investor sentiments have led to considerable volatility in gold prices.

Despite short-term fluctuations, the long-term trend of gold in India has largely been upward due to its cultural significance and as a store of value. However, the pace of increase or decrease depends on the interplay of multiple economic and geopolitical factors.

Impact on Different Sectors:

The fluctuating gold rates impact various sectors in India:

- Jewelry Industry: High gold prices can affect consumer demand for jewelry, impacting the jewelry industry’s profitability. Jewelers often adjust making charges or introduce lighter designs to accommodate price-sensitive customers.

- Investment and Financial Markets: Gold is considered a safe haven asset, and its prices influence investment decisions. It affects the performance of gold-based investment instruments like gold ETFs (Exchange Traded Funds) and sovereign gold bonds.

- Government Policies: The government often intervenes to regulate gold imports to manage the current account deficit. Policies related to import duties, taxation, and schemes like Gold Monetisation Scheme impact the gold market.

Future Outlook:

Predicting the future of gold rates is complex due to the interplay of numerous unpredictable factors. However, certain trends suggest that gold will continue to be sought after in India, especially during uncertain economic periods.

Conclusion:

The gold rates in India are influenced by a multitude of global and domestic factors, including international market trends, government policies, currency fluctuations, demand-supply dynamics, and socio-cultural sentiments. The historical significance of gold in India, combined with its investment appeal, ensures that it remains a significant asset class and a reflection of economic stability and prosperity in the country. Understanding the various forces that drive gold rates is crucial for investors, consumers, and policymakers in navigating the dynamics of this precious metal.