Interest Rates Today

Interest rates play a pivotal role in the world of finance, affecting borrowing, saving, and investing decisions for individuals, businesses, and governments, interest rates remain a topic of great significance, shaping economic landscapes and influencing financial behaviors globally.

Table of Contents

ToggleCurrent Interest Rate Landscape

As of the present, interest rates have been fluctuating, influenced by various economic factors and central bank policies. The central banks, including the Federal Reserve (Fed) in the United States, the European Central Bank (ECB), and others, have been employing strategies to maintain economic stability amidst changing global conditions.

The Fed’s interest rate decisions have a significant impact on the global financial markets. In recent years, the Fed had embarked on a path of gradual rate hikes to combat inflation while supporting economic growth. However, as of [Current Date], the Fed has shifted its stance, expressing a more cautious approach due to economic uncertainties.

The interest rates set by central banks serve as a benchmark for other interest rates in the economy. These rates influence the cost of borrowing for consumers and businesses, affecting mortgages, car loans, credit cards, and corporate borrowing. Therefore, changes in these rates can have a widespread impact on spending, investment, and overall economic growth.

Impacts on Borrowing and Saving

For individuals, the prevailing interest rates impact the cost of borrowing and the returns on savings. Lower interest rates often encourage borrowing by making loans more affordable, stimulating spending and investment. On the flip side, savers might experience lower returns on their savings accounts and fixed-income investments in a low-rate environment.

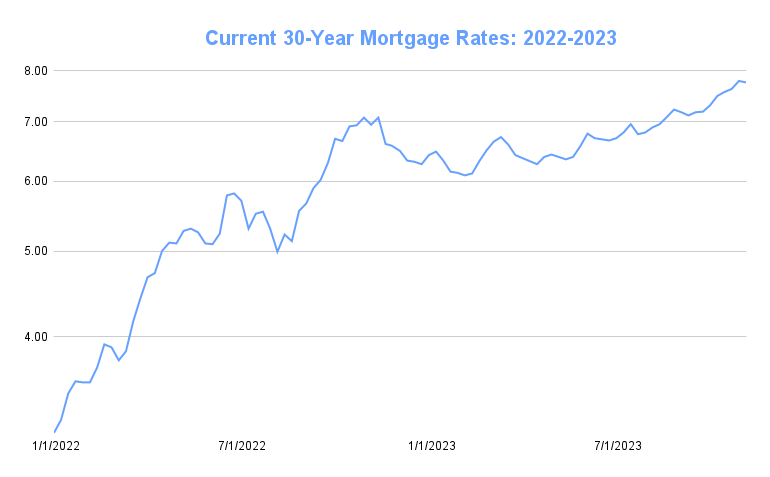

Mortgage rates, one of the most significant consumer interest rates, tend to follow the trend of central bank rates. Homebuyers and homeowners closely monitor these rates, as even a small change can significantly impact monthly payments and housing affordability.

Moreover, businesses rely on borrowing to finance expansions, operations, and innovation. When interest rates are low, the cost of capital decreases, potentially encouraging business investments that spur economic growth.

Investment Strategies in a Low-Rate Environment

In a low-rate environment, investors often reassess their strategies. With traditional savings accounts offering minimal returns, individuals might explore alternative investment options. Stocks, real estate, and other higher-risk assets may become more attractive to seek higher returns, considering the low yields in safer investments like bonds and savings accounts.

Additionally, bond markets experience shifts in yields inversely related to interest rates. When rates drop, bond prices tend to rise, benefiting investors holding these fixed-income securities. Conversely, rising interest rates can lead to bond price decreases, posing challenges for bond investors seeking capital gains.

Challenges and Opportunities

While low interest rates can stimulate economic growth and make borrowing more accessible, they also pose challenges. Prolonged periods of low rates can lead to asset bubbles, where inflated asset prices may not align with their intrinsic values. Furthermore, retirees relying on fixed-income investments might face difficulties generating sufficient income in a low-yield environment.

However, low rates present opportunities for businesses to invest, individuals to refinance existing loans at lower rates, and governments to manage their debt more affordably. Moreover, it encourages innovation and spending, which can potentially drive economic recovery.

Future Outlook and Factors Influencing Change

The future trajectory of interest rates depends on various factors such as inflation, employment levels, global economic conditions, and central bank policies. Inflation, in particular, remains a key concern for central banks, as they aim to strike a balance between supporting economic growth and preventing runaway inflation.

The ongoing geopolitical tensions, supply chain disruptions, and the post-pandemic recovery efforts continue to shape economic outlooks, impacting the decisions of central banks regarding interest rates.

Conclusion

Interest rates wield substantial influence over financial decisions and economic activity, the landscape remains dynamic, shaped by economic conditions and central bank actions. Individuals, businesses, and investors must stay informed about these changes to make informed decisions regarding borrowing, saving, and investment strategies in today’s ever-evolving financial environment.