Berkshire Hathaway Holding

In the vast ocean of financial markets, one name stands out as a beacon of investment wisdom and long-term success – Berkshire Hathaway. Founded by Warren Buffett and Charlie Munger, Berkshire Hathaway has become synonymous with shrewd decision-making, enduring value, and a commitment to excellence that has made it a powerhouse in the world of investing.

The Berkshire Hathaway Philosophy:

At the core of Berkshire Hathaway’s success is a unique and time-tested investment philosophy that prioritizes long-term value over short-term gains. Buffett and Munger are known for their aversion to market speculation and their emphasis on investing in businesses with strong fundamentals and sustainable competitive advantages. This approach, often referred to as “value investing,” has been the cornerstone of Berkshire Hathaway’s strategy for decades.

Diverse Holdings:

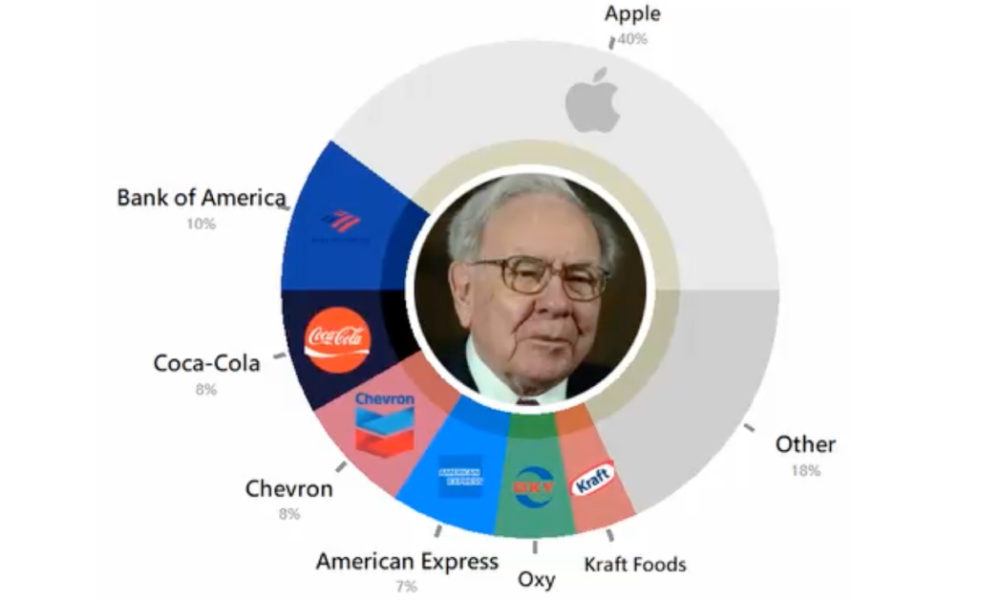

One of the distinctive features of Berkshire Hathaway is its diverse portfolio of holdings. The company has invested in a wide range of industries, from insurance and finance to energy, consumer goods, and technology. This diversity helps protect the conglomerate from the impact of economic downturns in any particular sector, contributing to its resilience and stability.

Iconic Investments:

Berkshire Hathaway is renowned for its iconic investments in well-known companies. The conglomerate’s largest equity holdings include major names such as Apple, Coca-Cola, and American Express. These investments not only showcase the company’s ability to identify industry leaders but also demonstrate its commitment to companies with strong brand recognition and global reach.

The Berkshire Culture:

Beyond its investment prowess, Berkshire Hathaway is also celebrated for its unique corporate culture. The annual shareholder meeting in Omaha, Nebraska, often referred to as the “Woodstock for Capitalists,” is a testament to the company’s commitment to transparency and shareholder engagement. Buffett’s candid and insightful discussions during these meetings have become legendary, providing shareholders with a glimpse into the mind of one of the world’s most successful investors.

Challenges and Adaptability:

While Berkshire Hathaway has enjoyed unparalleled success, it has not been immune to challenges. The conglomerate faced criticism for its cautious approach to technology investments in the past, but recent forays into tech giants like Apple demonstrate an ability to adapt to changing market dynamics. Berkshire’s ability to evolve and learn from its experiences is a key factor in its sustained success.

Conclusion:

Berkshire Hathaway Holding stands as a testament to the enduring principles of value investing, long-term vision, and adaptability. Under the leadership of Warren Buffett and Charlie Munger, the conglomerate has weathered market storms and consistently delivered value to its shareholders. As the financial landscape continues to evolve, Berkshire Hathaway remains a guiding light